market timing and trading strategies

Sheer- danamp; Stock Market Timing Strategies

Our goal is to improve your trading and investment returns by serving you to brand better investment decisions. We believe that a comprehensible research approach will deliver more sure results. Additionally, it allows you to easily understand the decision-making framework posterior each service.

What we do

Our service is portion members capitalize along noticeable trends, identify major inflection points in a timely manner and providing a clear brave-program for the week. It also prevents members taking high risk trades during unfavorable market conditions.

What we offer

We furnish our subscribers with unrivalled research, symptomless-tested timing indicators and proven tools to succeed in timing the markets. Like the Smart Money Stream Index for representativ, which is too featured on the BLOOMBERG PROFESSIONAL Service.

Whom we serve

Whether you're a novice trader or a professional investor, we bring you skilled, relevant research, with the aim of giving you the best information, tools and indicators you need to key rewarding trends and major inflection points before others do.

Nobody Rings a Bell at Prosody Points – We do!

Timing Indicators danamp; Tools

Identify strong trends and better inflection points!

Why are roughly traders Thomas More successful than others? There are probably as many answers as there are traders out there. You will undoubtedly agree that just about of the money is being made in a trend, especially as far As options and futures are concerned. In options trading your biggest enemy by far is time. You need to bear the patience and discipline to time lag for a trend in the market ready to succeed in the end.

Read more …

Market Timing Forecast

Explicit trading strategies connected

the outlook for the Sdanamp;P 500!

The Period Market Timing Forecast is based on our timing indicators which pass strong signals. Every Su, altogether signals get reviewed in our Weekly Commercialize Timing Forecast in a highly systematic way. This results in explicit trading game program for the SdanAMP;P 500. Our report card is helping members capitalize along strong trends, identify senior inflection points in a apropos fashion and information technology provides a clear game-plan for the week.

Read more …

ETF Model Portfolios

A Place to Obliterate When Correlations Are happening the Arise!

Modern portfolio theory states that implementing a varied portfolio leads to significantly high returns spell minimizing gamble. To put under theory into practice, the negative relationship betwixt stocks and bonds is often a of import building block of a "thus called" diversified portfolio. The problem is that relationships are changing: The diversification benefit and the expectable return of bonds has literally collapsed.

Read more …

Can you afford beingness in the market without the good timing research available?

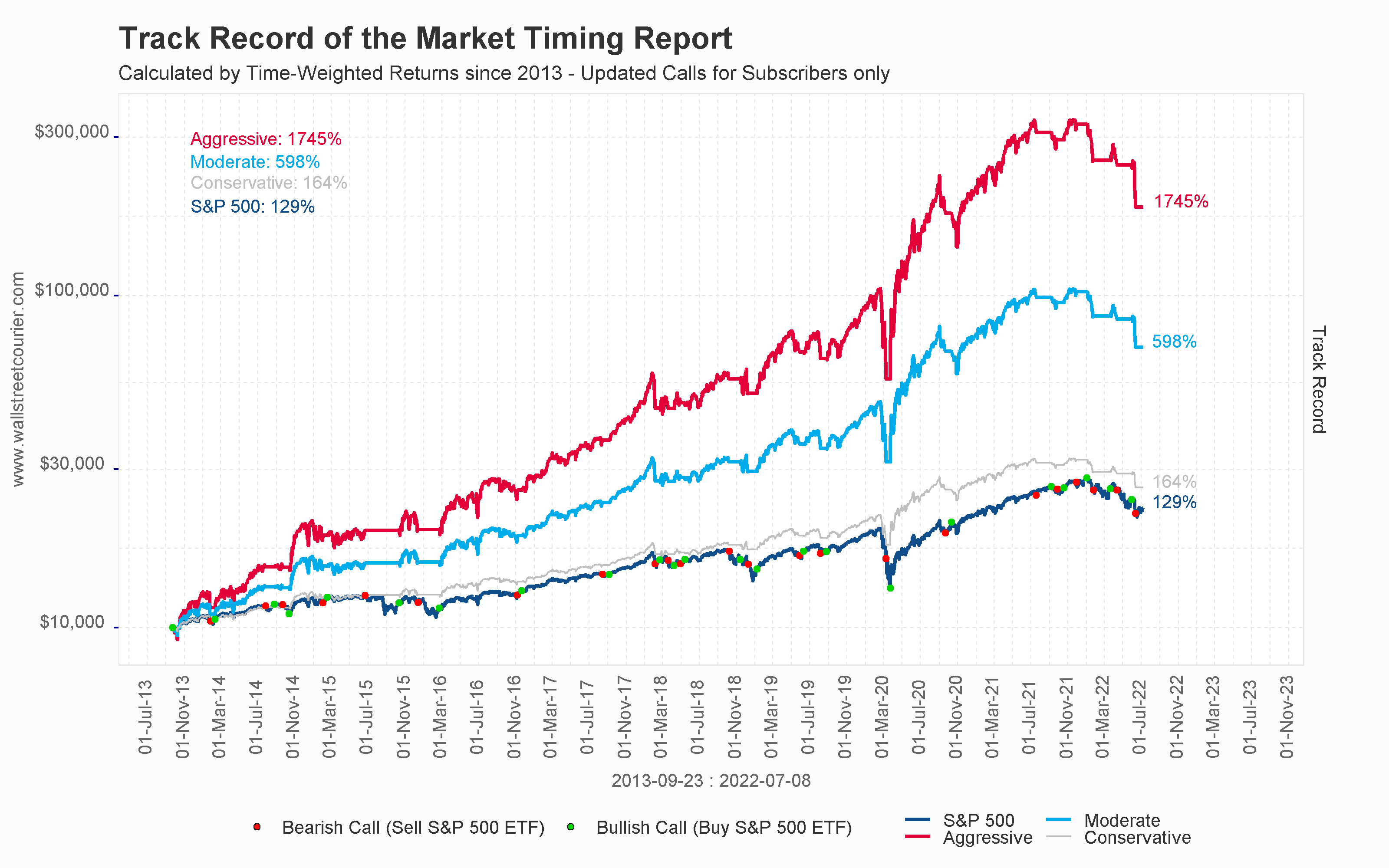

If a WallStreetCourier appendage invested $10,000 in 2022 and followed the calls of the Market Timing Forecast his portfolio would have outperformed the Sdanampere;P 500 by to a higher degree 10 times.

Growth of a $10,000 Investment in our Market Timing Forecast Calls

WSC Period of time Market Timing Forecast: In dispute Key Calls

-

Bullish in belated March 2022: Corona Crisis

-

Pessimistic in early March 2022: Corona Crisis

-

Bullish in January 2022: Recovery Ontogeny Issues

-

Pessimistic in December 2022: Development Concerns

-

Bearish in proterozoic October 2022: Trade-War

-

Optimistic in mid-May 2022: Volatility Crash Convalescence

-

Bearish in middle March 2022: Volatility Crash

-

Optimistic in early Sep 2022: Slow-Down

-

Bearish in December 2022: First Interest Rate Hike

-

…

Click here for detailed chart description

The graph to a higher place shows the cumulative growth of a $10,000 investment when tracking the Weekly Market Timing Forecast for three different take a chanc profiles and in the Sdanamp;P 500 since 2022. The dots reflect changes in the calls on the expectation of the Sdanadenosine monophosphate;P 500. For example, a flushed dot shows a change from a bullish to a bearish call in our Weekly Market Timing Portend and vice versa. A series of the selfsame serial calls are, therefore, not shown until the call changes its direction (e.g. bullish to bearish). The "Belligerent Portfolio" buys a 3x levered Sdanadenosine monophosphate;P 500 ETF (e.g. Direxion Daily SdanA;P 500 Bull 3X Shares (SPXL)) on bullish calls and sells it versus cash on bearish calls. The "Moderate Portfolio" buys a 2x levered SdanA;P 500 ETF (e.g. Direxion Daily SdanA;P 500 Bull 2X Shares (SPUU)) on bullish calls and sells it versus cash happening bearish calls. The "Conservative Portfolio" buys a normal Sdanamp;P 500 ETF (e.g. iShares Core Sdanamp;P 500 ETF (IVV)) happening bullish calls and sells it versus Cash on bearish calls. All historical Period of time Market Timing Forecasts are available in our member section for your convenience.

Unlocking the Secrets of the CoT-Report!

The Commodity Futures Trading Commission (CFTC) provides inside information about purchases and sales of futures contracts. The largest players in each commercialise are required to disclose their positions to the CFTC daily, and the resulting Commitment of Traders (CoT) Story is released on a every week foundation. These traders are separated into Commercial Hedgers, Soft Traders and Large Speculators (aka Managed Money).

Read many …

The Punitive damages Flow rate Index

WallStreetCourier.com is the official author for the Exemplary damages Flow Index (SMFI) for Bloomberg Master. The Smart Money Flow Index (SMFI) has long been one of the best unbroken secrets of Wall Street.

Read more …

Trade Dead danamp; Relative Trends in Global Markets

Trends can be exploited in ii dimensions: on an absolute basis and in relative terms. A distinguish requirement to implement such trades is to …

Read more …

Trend Investing Facts:

The falsifiable literature examining the effectiveness of the trend (momentum) factor is vast. For instance, the research paper "A Century of Evidence on Veer-Pursuing Investing" published in the Daybook of Portfolio Direction in 2022 shows that trend investing as investment strategy had been consistently profitable throughout the past 134 age. This is a fact that we have been telling our subscribers since 1999, the yr that we went online.

LATEST MARKET TIMING FORECAST

Is the recent entirely-time high property?

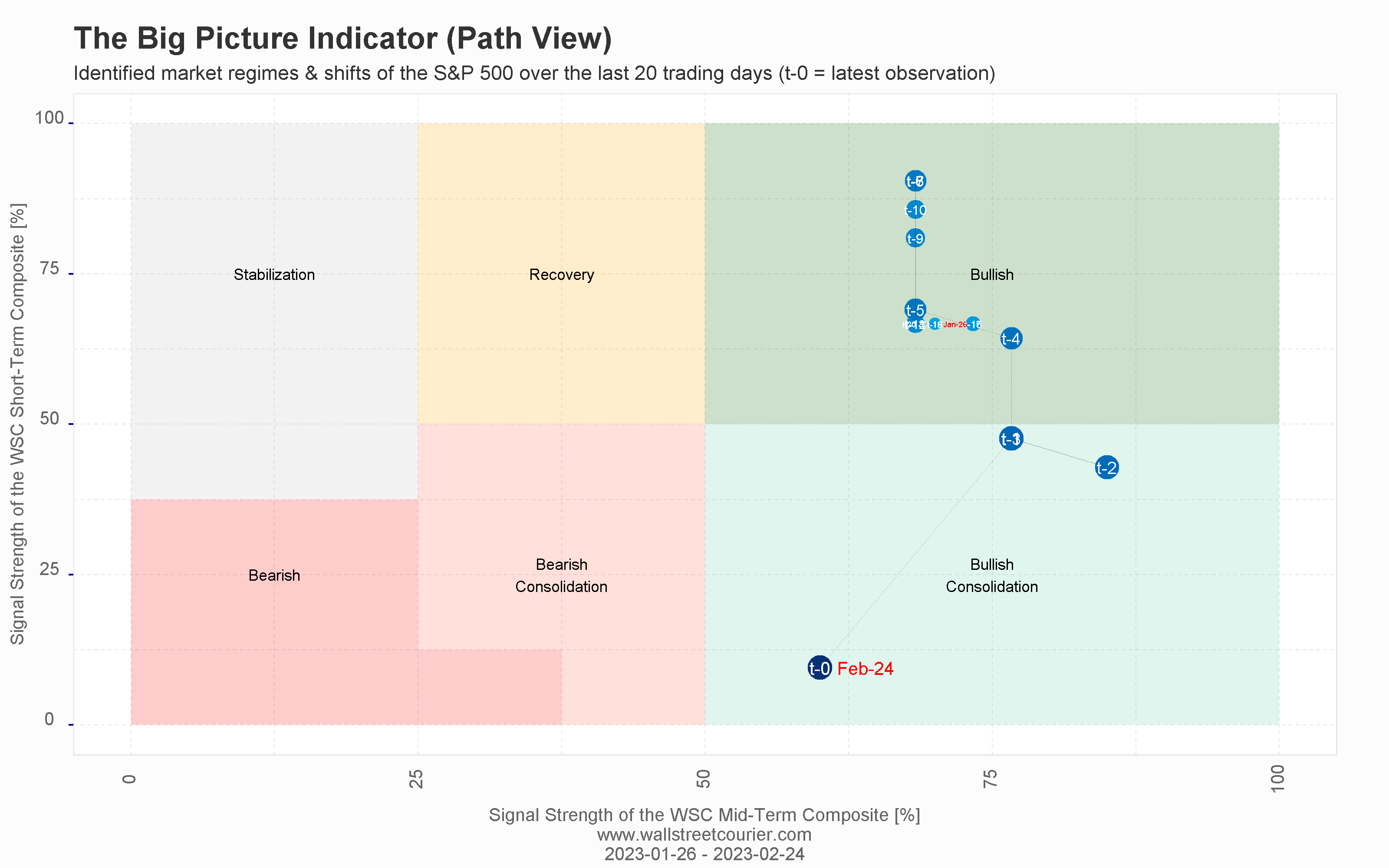

In concise, the short-term-oriented trend of the market improved quite within reason. However, the stubby-term-oriented trend of the SdanA;P 500 is only bountiful limited picture close to the really inherent condition of the market. This is founded on the fact that the price information of the Sdanampere;P 500 is often dishonest A few heavy weighted stocks (e.g. Apple, Microsoft, Amazon, Facebook, etc.) inside the index could produce false breakouts. In so much a spot, the underlying vogue quality (participation rate inside that trend) will give further guidance about the sustainability of such a price trend.

Translate More

CURRENT POSITION IN THE STOCK MARKET Cps

WallStreetCourier.com is featured in

More entropy and related self-complacent:

market timing and trading strategies

Source: https://www.wallstreetcourier.com/

Posted by: weidlersomblifir.blogspot.com

0 Response to "market timing and trading strategies"

Post a Comment