simple forex trading strategy a quick

Forex Trading for Beginners Usher

The forex commercialize is the largest financial market globally, with more than $6.6 trillion in trading volume occurring all day. Expected to the fast-paced nature of the market, many retail traders are drawn to forex trading – and with opportunities to make returns all single day, information technology's clear to see why.

This clause will act as a Forex Trading for Beginners Guide, covering everything you need to screw about the forex market. In addition, we'll discuss a selection of the best forex trading platforms and show you how to get set up and ready to trade under ten minutes.

Promptly Forex Trading Guide 2022

Are you looking to get started trading the forex market now? Look no foster – aside following the four stairs below, you'll follow healthy to streamline the process and lead off FX trading as quick as possible.

- Stair 1: Learn the basics – Habituate online resources such as courses and guides to profit a massive overview of the FX market and how it works.

- Step 2: Develop a strategy dannbsp;– Research various strategies and educate single that will beseem your schedule and risk tolerance.

- Step 3: Select a factor dannbsp;– Open an account with a accredited and reputable factor that will earmark you to trade the FX market. We recommend eToro.

- Ill-trea 4: Depart trading forex– Make a deposit, await for a live buy operating room sell opportunity to arise, and then begin trading the forex market.

What is Forex Trading and How Does it Work?

To be able to make money with forex, you need to begin with having a colourful understanding of how forex trading works. Forex trading is the process of exchanging one currency for another through the financial markets. This lavatory be as unproblematic as exchanging pounds for euros before you advance vacation – simply when we discuss forex trading in an investment sentience, it tends to mention to the process of speculating along currentness values for potential gains.

According to The Tokenist, the forex commercialise is the largest and most liquid market on world, with over 170 currencies beingness listed general. Ascribable the size and availableness of this market, retail traders worldwide will enroll the food market all Clarence Day and attempt to make returns on their capital. Notably, retail traders only correct a tiny percentage of global trading bulk – virtually of which comprises banks and large financial institutions.

As the forex commercialise is so blown-up and there are so many moving parts, we'll give out much of the critical components below, portion you realise how it works and how you can get involved.

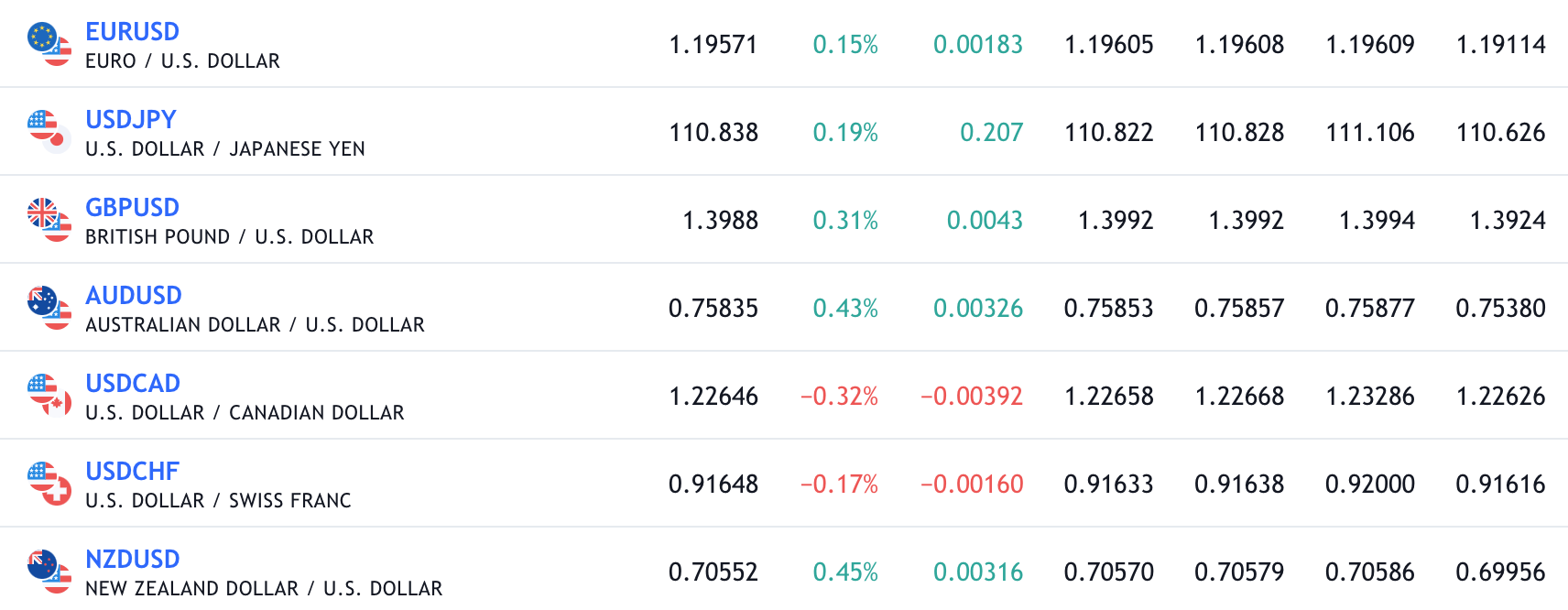

Forex Currentness Pairs

The first thing to understand about the forex market is that when you trade a currency, you'll actually be trading a currency pair. This may seem confusing at prototypal, but IT simply means you are trading one pair against another. Currentness pairs are quoted as a 'base' currency and a 'variable' or 'quote' currency. For example, if you were trading the Euro against the one dollar bill, it would be quoted as 'EUR/USD'.

Forex trading works by traders speculating on a rise in the base currentness against a give the variable/quote currency. To supply an example, if you awaited the Euro to appreciate against the dollar, you'd open a buy position in the EUR/USD currency duet. If the Euro went along to rise in value whilst the dollar declined, you'd be in profit. You can understand our EUR/USD forecast to learn more.

There are many currency pairs to swop, ensuring traders have lots of change in the market. Major pairs are the about liquid and are the ones that are most traded by both retail and professional traders. In addition, small pairs are less traded but can likewise showcase approximately great opportunities. Finally, exotics are currency pairs that are rarely traded and have pretty short liquidity – meaning these are best blessed for advanced traders.

Forex Trading Hours

The forex grocery operates 24 hours per day, five days per week. Atomic number 3 the market is round, there bequeath be certain times when markets are slow or fated days over the weekend where markets are closed.

The forex securities industry opens at 5pm EST along Sunday afternoons and closes at 4pm EST on Friday afternoons. Betwixt these times, the forex marketplace is open to all participants across the world through different 'sessions', such as the London, New York, and Asian sessions. These relate to the time of Clarence Day for each location and the level of trading activity that corresponds.

CFDs vs Spot vs Futures vs Options

There are numerous ways to trade the forex market, ensuring that every investor type is catered to. The list below summarises some of the independent ones:

- CFDs – CFD stands for 'Contract for Dispute' and is a contract that provides pic to fluctuations in the value of an asset without having to own the underlying asset. Many brokers will offer CFDs for FX trading to ensure a seamless trading experience and the ability to use leverage.

- Fleck – Spot trading means buying/merchandising a currency 'happening the spot' at the current market terms. About FX trading is conducted in this manner American Samoa spreads are narrower, allowing for quick trades.

- Futures – Futures are a case of contract where cardinal parties agree to exchange a currency for a specific price at a particular future date. Traders can use these contracts for both speculative and hedging purposes.

- Options – Options contracts apply traders the right (but not the obligation) to bribe/betray a vogue at a specified date in the future at a pre-determined price. Again, these can be used for both speculative or hedge purposes, e.g. if you do forex options trading.

Forex Pips danamp; Spreads

Forex trading for beginners means understanding what pips are and what the spread is. Put simply, pips are just a unit of mensuration put-upon to check the change in the value of a up-to-dateness. Pip stands for 'pct in charge' and, in well-nig pairs, pips volition agree to a change in the fourthly denary place on a currency quote. For example:

- EUR/USD is quoted at 1.1950

- The currency increases past 10 pips

- EUR/USD will now represent quoted at 1.1960

Spreads are the divergence between the bid and ask prices offered by a broker. Bid and ask prices refer to the cost to buy and the money you'd receive to sell a proper currency. These tend to differ, as the broker gets the difference as a sort of 'direction' for helping facilitate your swap.

Spreads ass broaden or narrow during trading hours, depending on excitableness and fluidity levels. A wider spread substance that you'll essentially be paying more of a 'fee' to trade in that up-to-dateness – so it's a good idea to use a broker that offers tight spreads.

Margin danadenosine monophosphate; Leverage in Forex

Leverage and margin are vital elements to understand when it comes to forex trading for beginners. Most of the time, when you trade the forex markets, you'll be utilising leveraging. Put merely, leverage allows you to amplify your position size by 'borrowing' money from your broker. This increases potential difference profits and increases potential losings, and then you essential be sensible when using leverage.

Leverage is quoted as a ratio – e.g., some brokers may offer 20:1 purchase when FX trading. This means that you pot essentially 'boost' your stake by 20x. If you wide a position worth $100 with your broker and then applied 20x leverage, your position size would comprise transformed to $2000. As your position size is now larger, potential profits/losses would be significantly increased.

Other thing to understand is margin. Margin refers to the amount of money you suffer to keep in your account to facilitate a leveraged trade in. Margin requirements differ depending on where you reside and the broker you use and can be expressed as a percentage or ratio. To bring home the bacon an example of this, if you wanted to undetermined a position size worthy $10,000 victimisation 10:1 leverage, then you'd have to have at to the lowest degree $1000 in your trading account.

Is Forex Trading Productive?

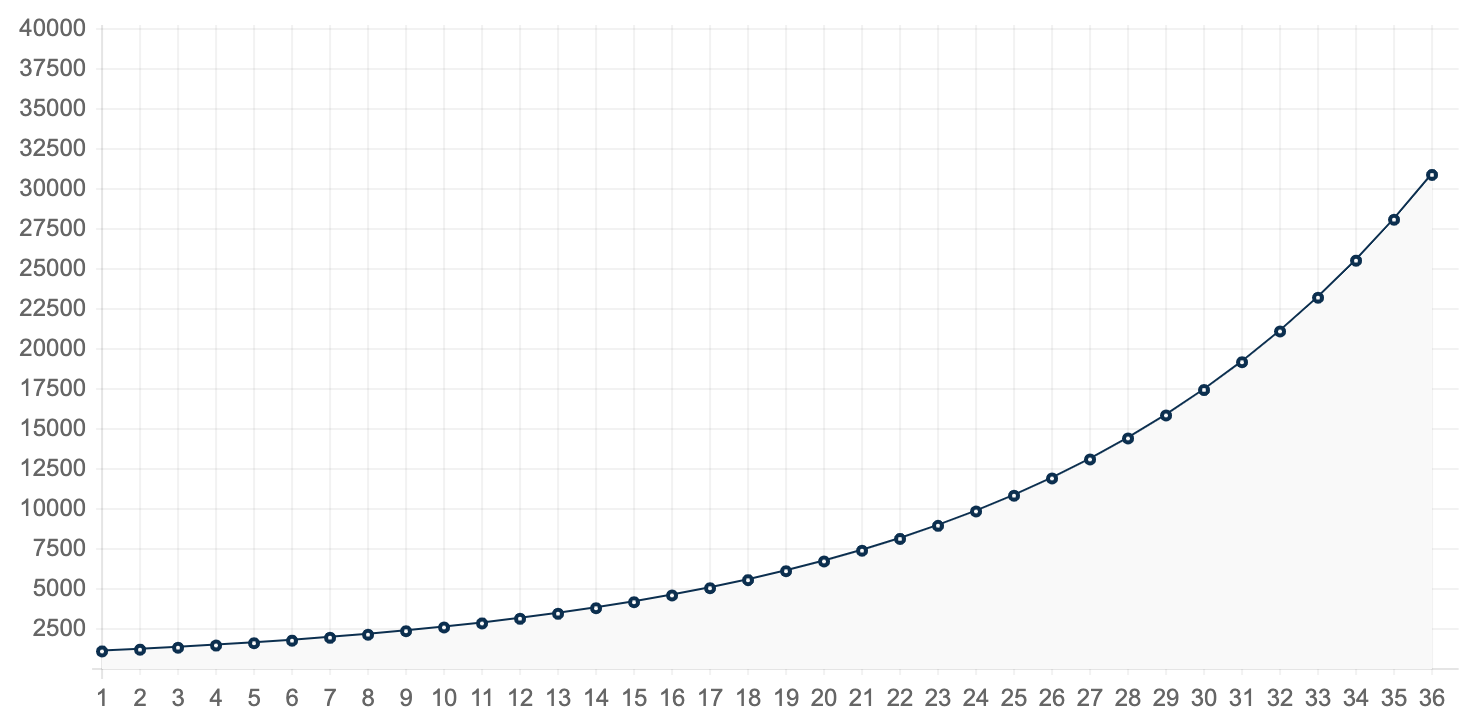

Trading forex can be an extremely profitable endeavour; however, to get to this equal will take time and discipline. Many traders feel they can enter the securities industry and make lots of money in real time – but ordinarily, this isn't the case. Decorous a profitable trader requires development and protruding to an telling trading strategy and flattering incrementally better over time.

Managing your risk is one of the critical components of proper a profitable trader. Common trading wisdom states that you should never risk to a higher degree 1-3% of your trading account size up happening a single merchandise – this ensures that you avoid blowing your account. Furthermore, it also plays on probabilities because if you risked 1% of your Libra the Scales on every transaction, you'd have to lose 100 trades in a row to bumble your score.

Becoming economic when trading forex also means ensuring your risk/advantage ratio is optimal for each deal. It's essential to make convinced that your potentiality reward outweighs your jeopardy – this means that if you only win half of your trades, you'll inactive represent profitable.

Overall, although it mightiness seem a daunting challenge to learn forex trading, the potential results hit it worthwhile. Old forex traders lavatory make ordered two-base hit-figure returns each month. With the power of combining, this can really grow your explanation balance exponentially over time.

How dangerous is Forex Trading?

Like all investments, in that location is an component of risk when trading the forex markets. The forex markets are so best-selling because of their inherent excitability, yet this volatility can potentially crop against you and do you to experience losings. This is why IT is thusly important to manage your risk/reinforcement and never chance more than you can give to lose.

There are single types of risk to take, but one of the primary types you testament experience relates to news or data releases. These market events canful drastically bear on a vogue's price by causing large spikes in unpredictability. Trading the market around these events can be possibly lucrative if you select the mighty focus – but it can constitute unfortunate if you don't.

Whole, the forex market is inherently risky, but if you employ a fitting strategy and correct risk direction, you ass significantly mitigate this risk. If you doh and then, thither's every chance you can begin trading effectively and generate positive returns.

Forex Trading Strategies

When you introductory start forex currency trading, you must bear a game plan for incoming the markets. Trading the forex market without a strategy is a sure-fire way to lose money – so determining a plan beforehand is one of the foundational forex basics for new traders.

Although there are many different trading strategies come out there, the three mentioned below are many of the most favorite amongst FX traders.

Scalping

Scalping is a trading strategy where traders will clear a status in a currency for a short period before closing for a tiny profit. Scalpers typically trade sour of the lower timeframes, such as the 5-minute or level the 1-bit charts. Unlike other strategies, scalpers are only sounding to make a couple of pips net rather than banking 10-20 pips per trade.

Scalpers may even trade respective market events such as forex news Oregon information releases, nerve-racking to grab a quick couple of pips amongst the volatility. Trades bequeath normally only last few transactions, with specific entry and release rules being hired by the trader. Scalping is a relatively risky scheme, as the FX market can turn against you in an fast – thereby rendering your craft a loss.

Clarence Shepard Day Jr. Trading

Another method of trading forex is through day trading. This strategy involves capitalising happening intraday moves within the market, commonly retention a position anywhere between 15 minutes to 8 hours. Typically, day traders will effort to rule out their position before the market closes so that they are not belongings their trade overnight.

Day traders often use study analysis to inform their trading decisions, using the charts to identify purchase or sell opportunities. Much like scalpers, day traders whitethorn also use grocery events as a jumping-remove aim to open positions. Daytime trading forex bottom be a potentially lucrative boulevard to explore dannbsp; – although it does take discipline and dedication to master.

Swing Trading

Swing trading is a Sir Thomas More 'long term' approach path and involves capitalising happening trends in price action. This scheme unremarkably means holding trades for years or even weeks in the hope of capturing a large number of pips. Swing traders will ofttimes use a combination of technical and fundamental analysis to identify a potential opportunity and and then coiffe a wide stop release so that the switch has room to breathe.

This scheme requires great discipline, as there's a high likeliness that the trade will go against you at some indicate during the holding period. However, as these trades are designed to live held for a Sir Thomas More protracted period, swing traders mustn't micro-manage the stead once information technology has been opened.

Best Forex Trading Platforms danamp; Apps

One of the most important steps when starting your trading journey is to choose a suitable broker. The best forex brokers testament allow you to sell the forex market in a aerodynamic and low-cost manner. Furthermore, many of them will offer a sacred forex trading app that will enable you to trade active.

To helper you decide which broker to pardner with, we've conducted complete the research and testing and narrowed the options down to our meridian three brokers for forex traders.

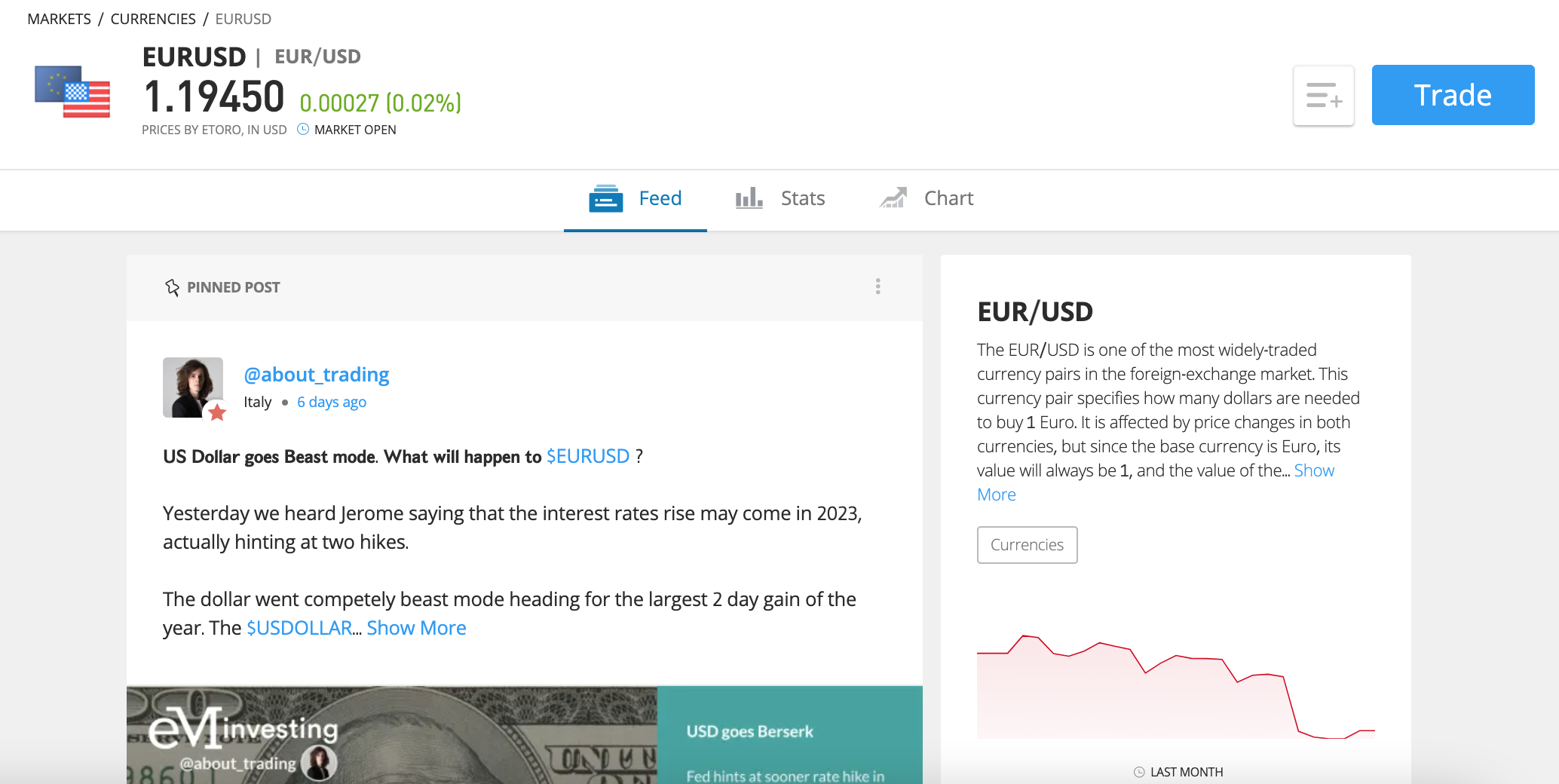

1. eToro – Overall Best Forex Trading Platform

Our big top selection when it comes to forex currency trading is eToro. eToro is the favoured broker of over 20 million multitude worldwide, thanks to its extensive regulation and low-cost fee structure. In terms of the former, eToro is regulated by tier-one entities such As the FCA and CySEC. This means that they must adhere to the strictest security measur standards, ensuring traders can operate in the markets safely and securely.

eToro does not charge any commissions when you place a trade – ideal for traders who are overactive in the markets. Instead, every last of eToro's fees are incorporated into the spreadhead, quoted on each currentness. eToro ensures that their spreads are as low as possible, with spreads on EUR/USD and USD/JPY typically existence only one pip.

Aside from their low fees, eToro also offers a whole host of valuable features. One of the best features they propose is an innovative CopyTrader feature, which allows you to view and automatically copy the trades of experienced eToro users in real-time. This feature is ideal for beginner traders as it bequeath enable them to determine the markets whilst still making a return – ensuring eToro are one of the best social trading platforms on the market.

Eventually, eToro's score opening process is seamless and unremarkably takes inferior than ten transactions to complete. Users can make deposits via credit/debit card, bank transfer, and various e-wallets. The great thing is that eToro does not charge anything to pretend a depositary – and charges no withdrawal Beaver State monthly account fees either.

Pros:

- Heavily ordered trading weapons platform used by finished 20 million multitude

- 0% commission on stocks and ETFs

- Spread-only pricing structure on crypto, indices, forex, and commodities

- Very cushy to use – philosophical doctrine for beginners

- The minimum stake starts at $25 per trade

- Supports debit/credit card game, bank transfers, and e-wallets

- Copy Trading features promote passive investing

Cons:

- Charting analysis tools are a trifle basic

67% of retail investors lose money trading CFDs at this site

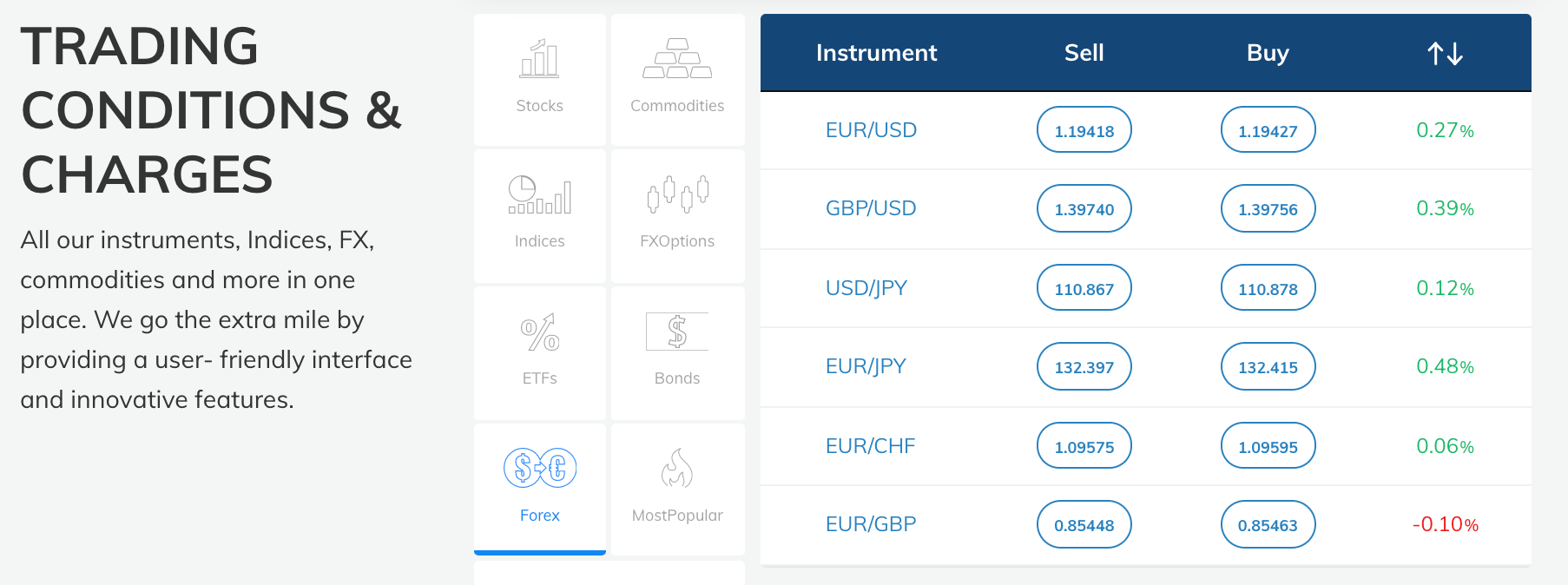

2. Avatrade – Superior Forex Agent for MT4 and MT5 Underpin

Many forex traders wish to use the super-pop MT4 Oregon MT5 platforms to behaviour their forex trading. If this applies to you, then Avatrade might be Charles Frederick Worth checking dead. Avatrade is regulated by multiple top entities such as CySEC and ASIC, ensuring they use the strictest security policies. Much suchlike eToro, this MT4 broker does not charge whatever commissions when you place an FX trade – instead, Avatrade incorporates its fee into the tight spreads it offers.

As Avatrade offers full support for both MT4 and MT5, this allows users to take extensive technical analysis through custom indicators. Furthermore, users can even utilise various forex robots if they wish to automate their trading. If you're looking to get started with Avatrade, their minimum deposit is only $100, which bum be made via cite/debit entry card, bank transfer, operating room several e-wallets. Finally, you can even learn forex trading using Avatrade's free demo account – allowing you to gain adventure-free experience in the market.

Pros:

- Regulated in 6 varied jurisdictions

- Supports CFD markets connected forex, stocks, cryptocurrencies, and more

- 0% commission and low spreads

- Compatible with MT4 and MT5

- Minimal posit of just $100

- Leveraging offered on all markets

Cons:

- Stock CFD section is constricted in comparison to strange platforms

71% of retail investor accounts lose money when trading CFDs with this provider

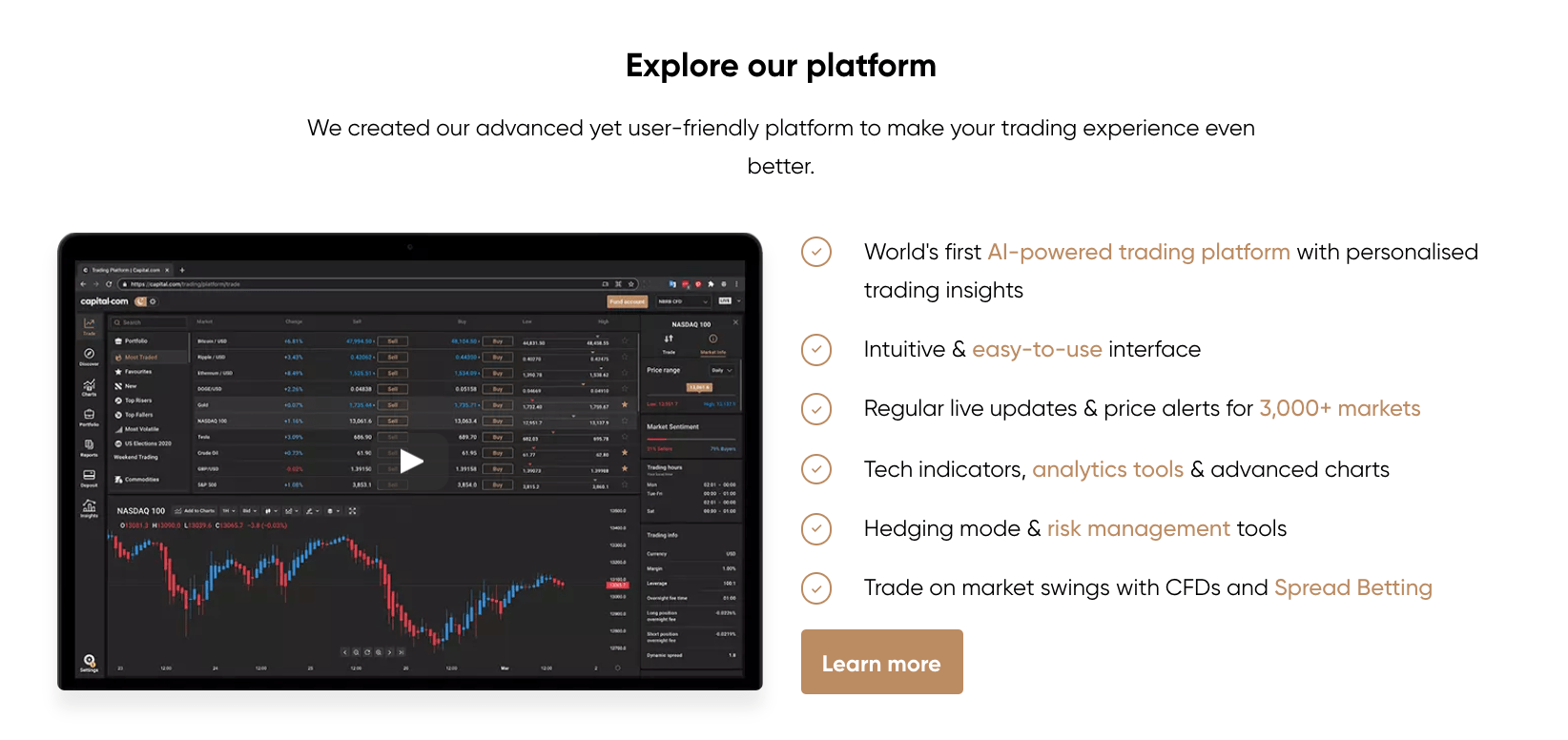

3. Capital.com – Best Forex Broker for New Traders

Superior.com is an excellent option for newbies looking to deal out forex as they offer a easy platform with a extraordinary fee social organization. Primary.com has been in military operation since 2022 and is regulated by the FCA and CySEC. Notably, Great.com primarily focuses on CFD trading, allowing users to hypothesize on currencies without actually owning them. Referable this, Capital.com offer up to 30:1 leveraging – enabling you to boost your position size up and voltage profits.

Capital.com does not charge any commissions, and the spreads they offer are competitive and you would like to know that this agent as wel has one the best no deposit forex bonuses. When you sign up for a new live chronicle for trading, you get $50.. Some other expectant feature of Capital.com is the comprehensive depository library of educational material that they offer. Users can read various guides and articles and even use the Great.com TV feature, which analyses current commercialise events. Finally, Capital.com control they are handy to everyone with a low minimum deposit of only $20, which can personify made via credit/debit card, rely transfer, Oregon varied e-wallets.

Pros:

- 0% commission and tight spreads

- Thousands of markets on offer

- CFD asset classes include crypto, stocks, forex, and commodities

- Nominal deposit of just $20

- Supports debit/citation cards and e-wallets

- Great for beginners

- MT4 supported

- Leverage available – limits depend on your location

Cons:

- You buns't invest in the underlying plus – CFD instruments only

67.7% of retail investor accounts lose money when trading CFDs with this provider

Types of Forex Accounts

When you decide to trade forex, you'll give birth a variety of account types to choose from, much as forex mini accounts. This pick may seem daunting at first – but most of them are very simple to understand. The list below presents the various forex accounts you can choose from:

- ECN – Most people who craft forex will desire to use this news report type or an STP invoice. ECN accounts provide traders with maneuver approach to the vogue marketplace, allowing buyers to be mated seamlessly with sellers. This removes the middleman from forex trading and usually means a lot lower spreads.

- STP – An S.t.p. account removes the dealings desk component of traditional market makers and easily connects traders with liquidity providers so much A Sir Joseph Banks operating room hedge funds. S.t.p. accounts are usually offered by brokers and result in fast instruction execution speeds. Notably, brokers will often saddle a spread for this service of process of pairing traders with liquid providers.

- MAM/PAMM/LAMM – Mam stands for Multi-Account Manager and fundamentally allows a stock manager to operate multiple trading accounts through indefinite single account. Traders can join with this manager and receive profits supported the trades the manager makes. PAMM accounts are very similar and provide traders to seat their money with a coach – in turn, the manager will trade the pooled Das Kapital and hand out the profits (minus his take) back to the traders. Finally, LAMM accounts function by the investor choosing the amoun of lots that arse be listed; this account character is most suitable for larger accounts.

- Demo – This describe type is a peachy way to learn forex trading as it does not require any 'realistic' money to operate. Most brokers will offer a free demo account for beginner traders to use, which will come with a balance of 'demo money' that users can trade with.

Automated Forex Trading

Forex trading for beginners can be tricky – which is why companies offer specific tools and resources to improve traders' results instantly. Below are two of the superfine methods of growth potential drop profits direct forex automated trading.

Forex Signals

One of the best forex tools that traders can use is forex signals. These help semi-automate forex up-to-dateness trading by providing well-researched trade opportunities that sole need the trader to place the trade. Usually, these signals are transmitted in the form of a school tex message or email directly to the trader's smartphone.

Forex signals providers will act up all of the research ahead, meaning that traders who work full-time jobs or just don't take up enough time to research the commercialise can tranquillize trade efficiently. These signals will usually specify the currency to be traded, along with an ledger entry point, exit tip, and arrest-exit level.

Forex Robots

If you're looking to automate your trading fully, then forex robots are the way to go. These robots are specially designed pieces of software that desegregate with MT4 or MT5 and will place trades on your behalf. Forex robots incline to have their have unique strategy and will mechanically scan the markets 24/5 for trading opportunities.

Victimization forex robots is ideal for citizenry who do non give birth the time to deal out the markets but still will to try and wee-wee a get back on their uppercase. Forex robots are unremarkably sold-out past 3rd party providers and only require a ready installation before being ready to use. Notably, these robots will pauperization access to your trading Capital to automate your trading in full – so make sure the one you opt is from a prestigious source before legal proceeding.

Forex Trading Tips

Trading the forex market seat exist lucrative – however, information technology can also be unstable if you begin trading offhanded. Here are five top tips that you can economic consumption to ensure you trade wind effectively and optimally.

1. Take the emotion unsuccessful of it

One of our exceed tips for forex traders is to remove emotion from your trading. Novice traders typically get emotional and make wrong decisions, leading to losings. Cente objective criteria, and don't worry if you miss a trade. Also, you potty choose to choose a managed forex business relationship.

2. Start with a demo chronicle

Trading the forex securities industry tin be tricky initially, so starting with a demo invoice is a great tactic to use. This allows you to beat close with the trading platform and the concept of placing trades.

3. Always use a stop loss

It would follow best if you always used a stop consonant loss when placing a forex trade. The forex market is inherently volatile, so operating without a stop loss will always leave you open to blowing your chronicle.

4. Understand that all trade in may resolution in a loss

Devising sure you'Ra aware that every time you place a trade, it could termination in you losing money. This mindset will help you manage trades correctly and stupefy to your strategy.

5. Economic consumption a safe and low-monetary value broker

Finally, it's essential to manipulation a broker that is suitable for your trading needs. Also, using a organized broker such as eToro is crucial arsenic it prevents you from organism scammed or from having your details breached.

How to Starting line Trading Forex

Now that you have a comprehensive overview of the forex market and how it whole kit, let's look at the process you need to follow to start trading. The stairs below will show you how to get place aweigh and ready to trade with our recommended FX broker, eToro.

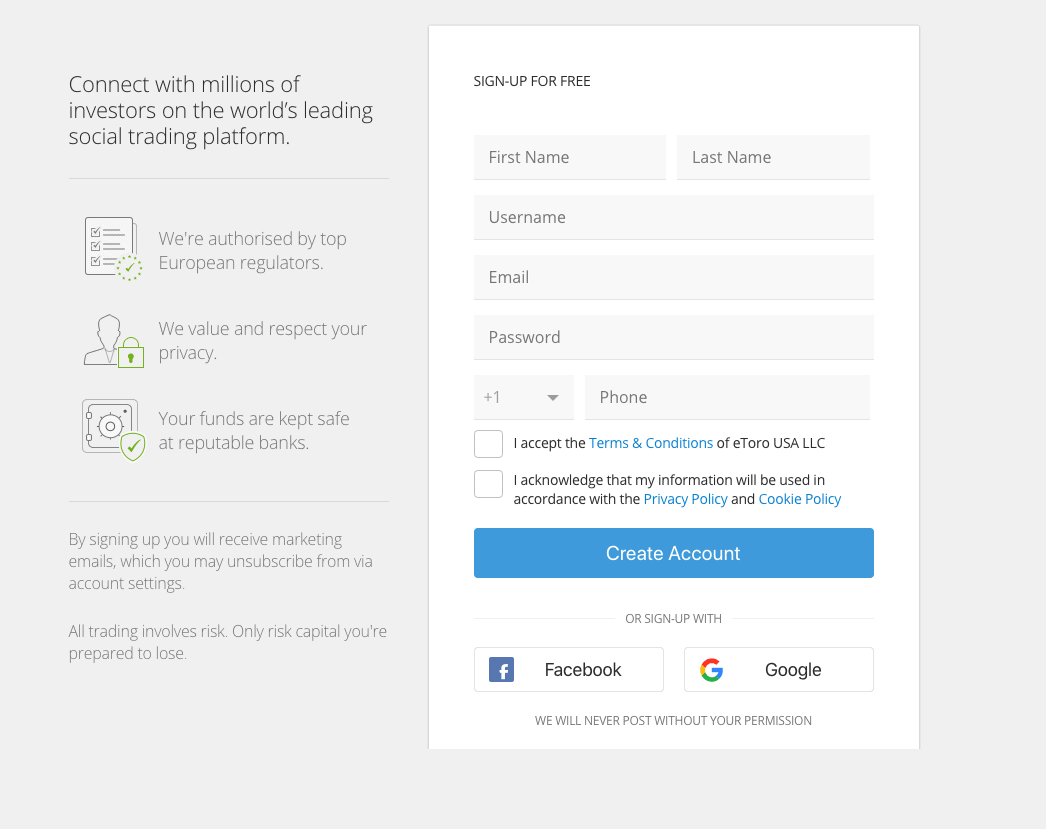

Step 1: Open an eToro Account

Nou ended to eToro's website and click the 'Join Now' button. Close, move in a logical email address and choose a word for your account. If you'd like, you can complete this step through eToro's app – i of the best trading apps available to FX traders.

Step 2: Verify your Account

As eToro are extremely regulated by top-tier entities, new users must verify themselves before trading. To do thusly, simply upload proof of Idaho (a copy of your recommendation or driver's permit) and proof of address (a re-create of a money box statement or utility bill). These documents will then be verified by eToro's team up, which usually alone takes a few minutes.

Step 3: Fund your Account

eToro requires a minimal deposit of $200 for new users; however, this drops to simply $50 for any subsequent deposits. Notably, if you are based in the US, your initial alluviation only has to be $50.

In terms of deposition methods, eToro accepts the pursual:

- Charge plate

- Debit batting order

- Bank transfer

- PayPal

- Neteller

- Skrill

- Klarna

- Trustly

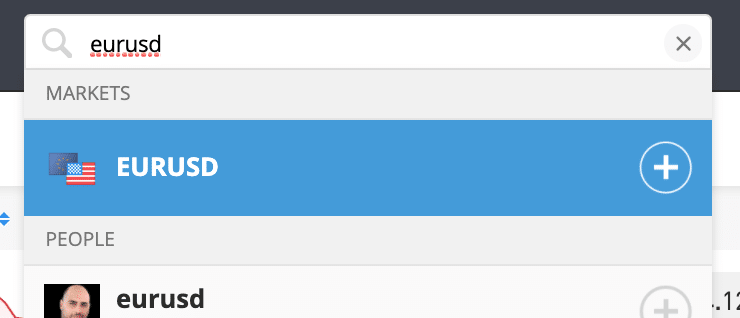

Step 4: Search for a Vogue to Trade

Click into the search bar at the top of the screen and type in the name of the currency couple you are looking to trade. For the purposes of this guide, we'll be trading EUR/USD. Select the currency pair from the drop-down menu and click 'Trade' on the following screen.

Whole tone 5: Place a Forex Deal out

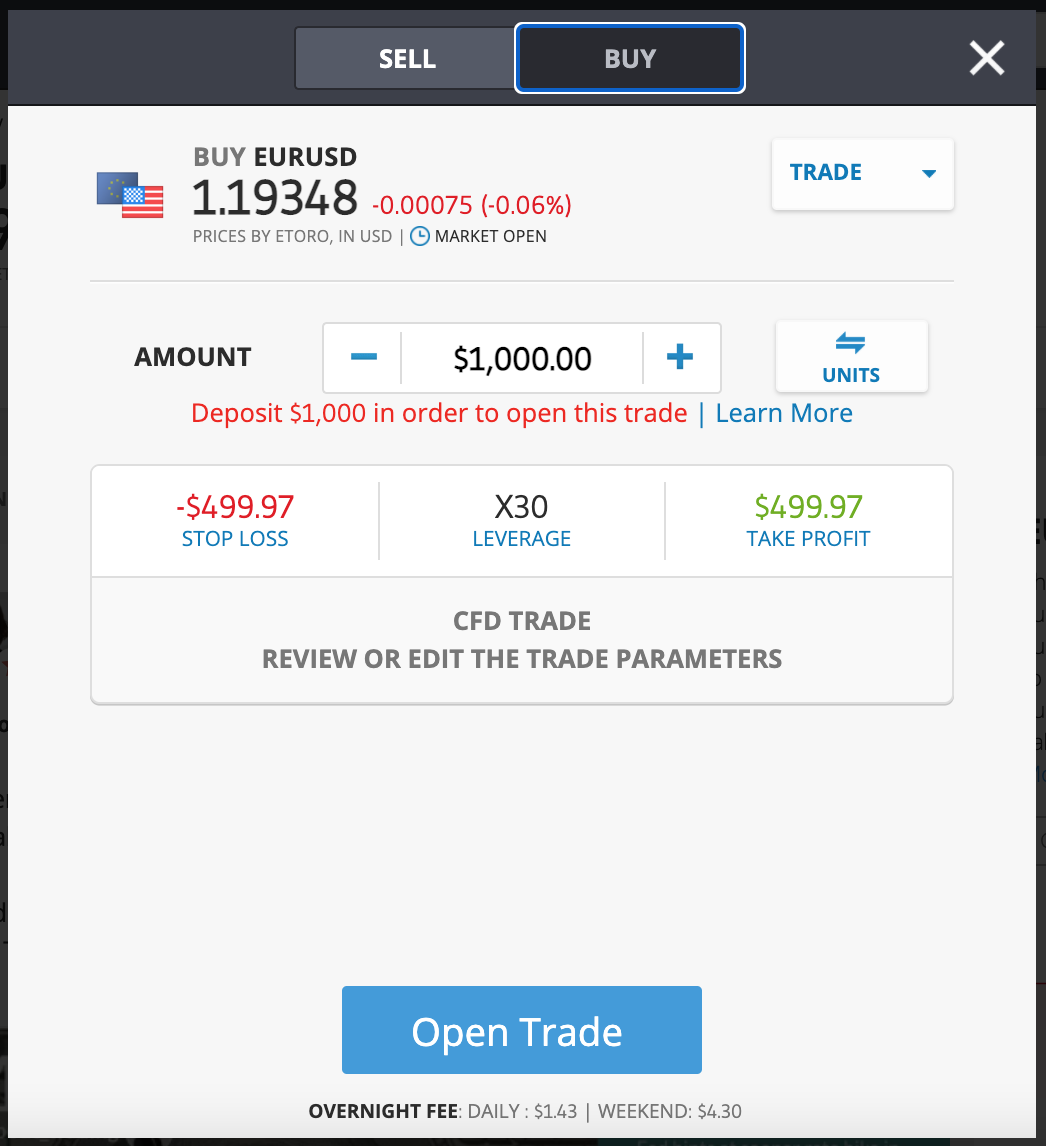

An order box will now come along, which will spirit care the unrivalled on a lower floor. Firstly, pick out whether you are looking to buy out surgery betray the currentness pair victimization the toggle at the top of the box. Next, enter the measure you'd like to trade and adjudicate whether you wish to employ leverage. At length, destine your kibosh loss and guide profits levels (if you want) and dog 'Open Trade'.

Praise! You've just placed a forex trade with one of the top FX brokers – all without stipendiary some commissions!

Forex Trading for Beginners Channelis – Conclusion

In summary, trading the forex market is a great way of life to speculate connected the valuate of currencies in a straightforward and quick manner. With so many strategies to use, traders will never beryllium short of market opportunities. Furthermore, thanks to the technology we have at our fingertips these days, trading the forex grocery has never been easier – ensuring retail and professional traders can operate in the FX market at all times of the Clarence Shepard Day Jr..

If you'd like to depart trading the forex market right away, we'd recommend creating an account with eToro. eToro does non charge whatever commissions when you grade a trade, and spreads are competitive with other round top brokers. In addition, eToro also offers an innovational CopyTrader feature that allows you to automate your FX trading – perfect for beginners WHO wish to learn the market whilst still making a return.

67% of retail investors lose money trading CFDs at this web site

FAQs

How does forex trading work?

Trading the forex market involves speculating connected the price of a vogue to make a return. Currencies in the FX commercialise are quoted as pairs, so you essentially mull over on whether ace currency leave rise or decline in valuate against another.

Is forex trading legit?

Yes – forex trading is a legitimate process conducted by institutions and large banks all day. These entities make up the vast majority of FX trading volume, with retail traders only chronicle for a small portion.

Is forex trading legal?

Course! Forex trading is completely legal and is an essential component of the business conducted by banks and financial institutions.

How do I learn forex trading?

Receivable to the popularity of forex trading, there are more resources online that can help you learn the ins and outs of the forex securities industry. One great way to find out is to take a course that will provide a comprehensive overview of the market and how it whole kit and caboodle. You could also utilize a demonstration account with a good broker to gain risk-free experience in the market.

What are pips in forex trading?

Pips are only a unit of measurement that are used to measure changes in a currency's value. Most currencies are quoted to iv decimal places, and a pip refers to the high of the four digits.

What is gross profit margin in forex trading?

When using leveraging, edge refers to the amount of money you must birth in your trading account to help the trade. Margin give the axe be expressed as a ratio or a percentage – for example, if you wanted to open a trade worth $10,000 using 1:10 leverage, you'd have to have at least $1000 in your account.

How is forex trading taxed?

Forex trading is taxed differently depending on which country you lodge in in. It also depends on whether you are spread card-playing or using CFDs. For example, if you are spread betting in the UK, you will not have to pay income taxation; on the other bridge player, if you are trading CFDs, you'll be subject to capital gains tax. Our advice is to research this issue thoroughly to ensure you know if you'll need to wage taxation and how much.

How overmuch money do you need to start forex trading?

The great thing about the forex market is that it's accessible to jolly much everyone – you can start trading with some amount you please! The only matter to keep an eye out for is your factor's minimum bank doorsill – usually, these range between $50 to $200.

How many forex trading days in a year are there?

In 2022, there are precisely 252 trading days. On average, there are 253 trading days per twelvemonth, after taking into account weekends and holidays.

simple forex trading strategy a quick

Source: https://www.forexcrunch.com/forex-trading/

Posted by: weidlersomblifir.blogspot.com

0 Response to "simple forex trading strategy a quick"

Post a Comment