Daily Chart Forex Trading Strategy

Trading daily timeframe is non exciting to most traders.

Information technology is slow.

It requires a ton of patience.

It has fewer trading opportunities.

Still…

Trading daily timeframe is the answer for nearly traders (with many "hidden" benefits) — peculiarly if yous have a full-time job.

Hither's why…

The truth about trading daily timeframe

You might not know this but, trading daily timeframe offers many benefits not establish on the lower timeframe.

I'll explain…

1. Y'all're more than relaxed and make better trading decisions

Allow me inquire you:

Have you ever traded on the 5mins timeframe?

Then you'll hold it can exist stressful because a new candle is formed every 5minutes.

You've got to brand a determination to purchase, sell, hold, or stay out in a short period of time.

This ways you have less time to call back which crusade you to brand wrong trading decisions (similar chasing the markets).

On the other mitt…

If you trade the daily timeframe, a new candle is formed every 24 hours.

Y'all take more time to call back, plan and execute your trades — so you're less prone to making the wrong trading determination.

The end outcome?

Yous brand improve decisions, your results improve — and trading becomes more relaxed.

ii. News events don't affair

Hither'south the thing:

When you trade on the lower timeframe, news events (similar FOMC, NFP, etc.) is a large thing.

You'll notice the price goes "crazy" and flies up and down on your charts.

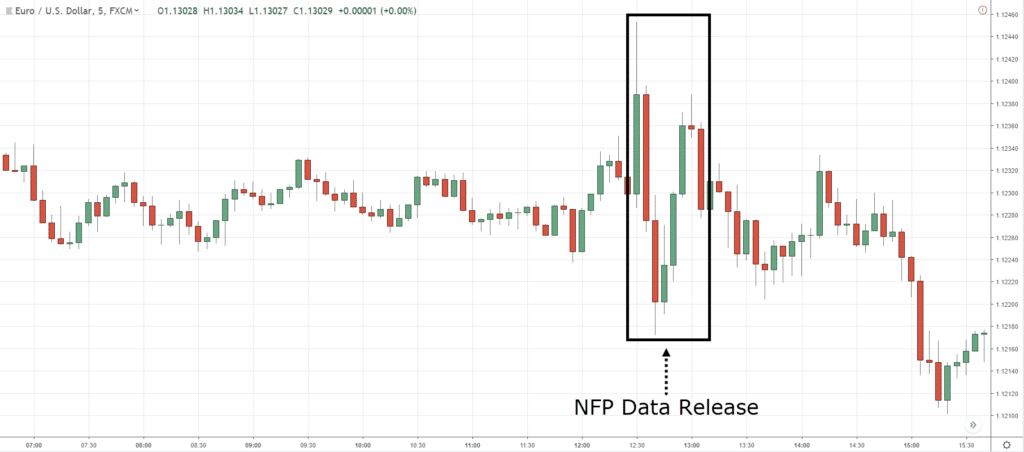

Here's an example: NFP on EURUSD 5mins timeframe:

This means if you trade the lower timeframe you must be enlightened of the news or, you'll get stopped out for nothing.

Merely…

If you trade the daily timeframe, and then news outcome hardly matter.

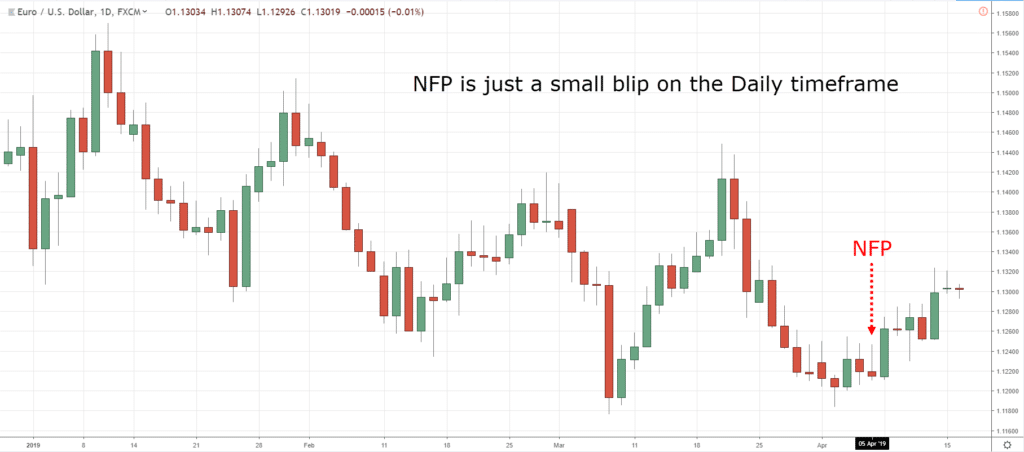

Here's an example: NFP on EURUSD daily timeframe:

Notice there's only a pocket-size blip on the chart?

You lot're unlikely to get stopped out of your trades every bit your end loss is wider (and can arrange the "crazy" swings on the lower timeframe).

And so the bottom line is this:

If you lot trade the higher timeframes, the less impact news has on your trading.

3. Y'all have liberty

Here's the matter:

The daily timeframe but paints a candle once per 24-hour interval.

So there's no demand to constantly spotter the markets because there's "cypher" to practice till the market closes (and a new candle is formed).

Imagine, how much more than liberty you'll have when you're no longer a slave to the markets?

iv. Yous can chemical compound your returns and grow massive wealth (even with a small-scale trading account)

At present every bit a daily timeframe trader, you don't need to spend all day watching the charts.

This means you can get a total-fourth dimension task and combine with trading to grow massive wealth.

Let me prove it to you…

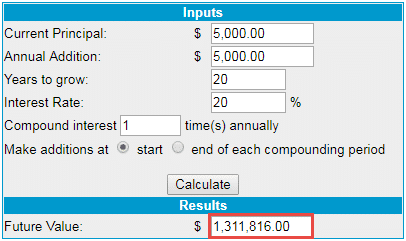

Let'south say you make an average of 20% a year with an initial sum of $v,000 and you lot contribute $5000 to your account each year.

Practice y'all know how much it'll be worth after 20 years?

Afterward twenty years, it will be worth…$1,311,816.

BOOMZ!

5. You can focus on the process and become a consistently profitable trader, fast

I've seen many traders who go all in to trade full-fourth dimension, and fail.

Now it doesn't affair if their trading strategy works or not because the odds are against them.

Why?

Considering they come across the "need to make money" syndrome.

This is where you break your trading rules (like widening your end loss) to avoid a loss.

The reason you do it is because you rely on your trading profits to pay the bills — and y'all'll do whatever it takes to prevent a loss.

But if you're trading the daily timeframe, then you can have a full-time task.

And at present the odds are in your favour because you don't have to rely on your trading profits.

Even if you have losing months, information technology's non the end because your job volition provide your living needs.

This means you can focus on learning how to trade and not worry about whether you can pay the bills.

Won't this help you lot go a profitable trader in the fastest possible fourth dimension?

six. You put the odds in your favour

Now…

One of the biggest reasons why traders neglect is considering they don't pay attention to the transaction cost.

And that tin be a difference between a winning and losing trader.

Let me explain…

Imagine…

- Yous have a $10,000 account

- Transaction cost is $x per trade (purchase and sell)

- You identify 500 trades per year (from day trading)

If you exercise the math, you need a return of 50% simply to break even!

Only what most trading daily timeframe?

Again…

- You have a $10,000 business relationship

- Transaction cost is $10 per trade

- You place 50 trades per year (longer-term trading)

Now, y'all just need 5% to breakeven — a big difference.

Tin can you lot see how transaction cost is a killer?

So if you want to put the odds in your favour, trade smarter and merchandise bottom.

And so, is trading daily timeframe for you?

Now I'll be honest.

Trading daily timeframe is non for everyone because different traders take different goals.

So, if you fall into any of the categories beneath, then trading daily timeframe (or higher) isn't for y'all.

Trading daily timeframe is NOT for you if…

- You want to generate a consistent income

- Yous want "fast action"

- Y'all're into proprietary trading

Here'southward why…

Why trading daily timeframe don't offer you lot a consistent income

When you the college timeframe, you have a lower trading frequency.

This ways yous need fourth dimension for your edge to play out (possibly over a few months).

So, if you're looking for a consistent income from trading, this approach is non for you.

Why trading daily timeframe is not for "fast action" traders

Here's the deal:

Every candle on the daily timeframe is painted once per day.

It'southward a irksome trading arroyo for traders who don't want to exist glued to the screen all day.

Why trading daily timeframe is a proprietary trader'south nightmare

The goal of a proprietary trader is to generate a consequent income from trading (by trading often).

But as you lot've learned, trading the daily timeframe doesn't allow your edge to play out fast enough to generate a consistent income

Does it make sense?

Great!

So make up one's mind now whether trading daily timeframe is for yous.

Because if it isn't, so you can terminate reading and observe something else that suits you.

Just if you know it's for you, so read on…

Trading strategy for the daily timeframe

The ii most common ways to trade the daily timeframe are…

- Swing trading

- Position trading

I'll explain…

Swing trading

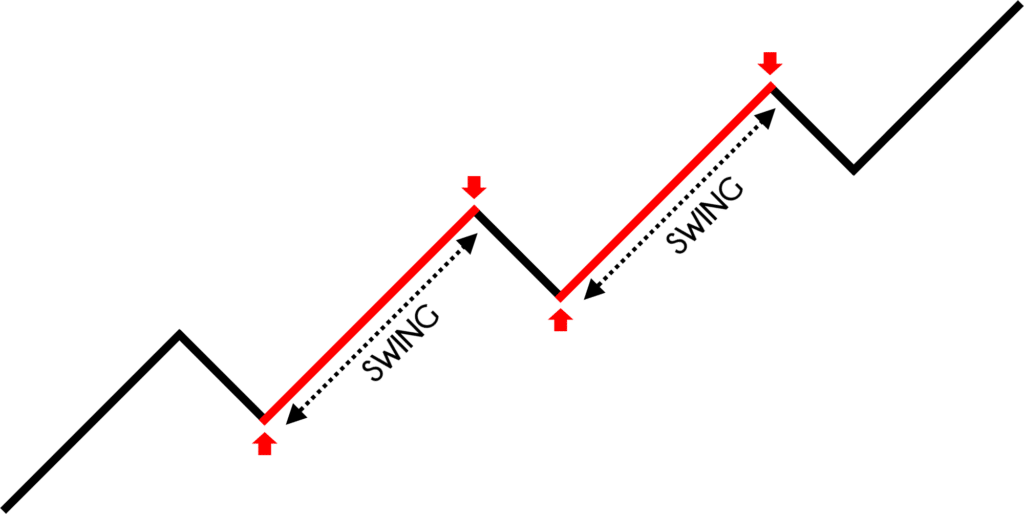

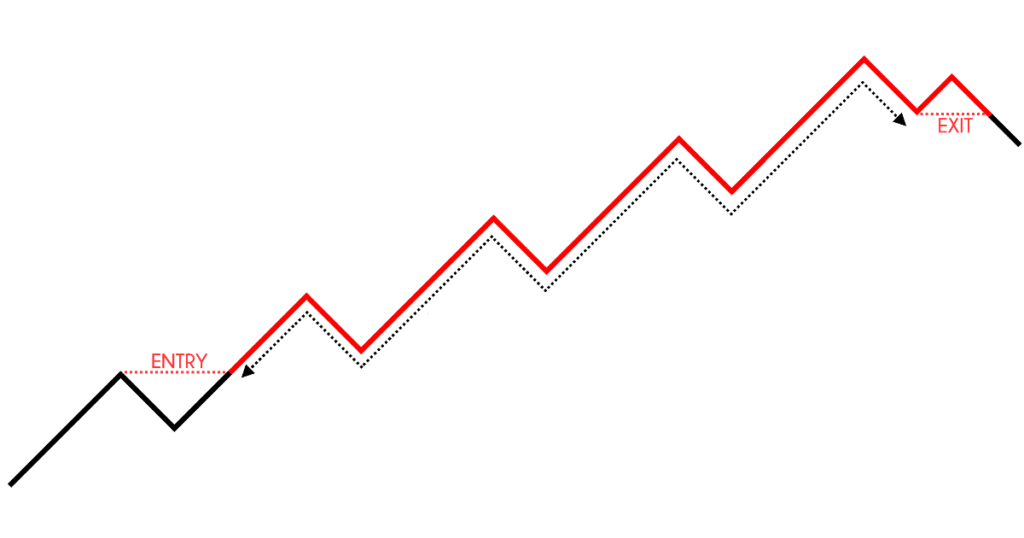

Swing trading is an approach which seeks to capture "1 move" in the marketplace.

The idea is to endure every bit "little pain" every bit possible by exiting your trades before the opposing pressure level comes in.

This means you'll book your profits before the market reverse and wipe out your gains.

Here'southward what I mean…

Pros:

- You lot don't demand to spend hours in forepart of your monitor because your trades last for days or even weeks

- It's suitable for those with a full-time task

- Less stress compared to day trading

Cons:

- You won't be able to ride trends

- You lot accept overnight risk

If you want to learn more, then become read…

The NO BS Guide to Swing Trading

Swing trading strategies that work

Next…

Position trading

Position trading is an approach which seeks to ride trends in the market.

The idea is to capture "the meat" of the move and go out your trades only when the trend shows signs of reversal.

Here's what I mean…

Pros:

- Information technology requires less than 30 minutes a day

- It's suitable for those with a full-time task

- Less stress compared to swing and day trading

Cons:

- You'll watch your winning trades turn into losing trades, frequently

- Your winning rate is low (around thirty – forty%)

If you lot want to acquire more, and then get read…

The NO BS guide to Position trading

v Powerful Ways to Trail Your Terminate Loss

Now, once you've developed your trading strategy, the next step is to develop a routine to ensure your trading success.

Go on reading…

The secret to daily timeframe trading success

(This is important so don't skip this department.)

At present…

A trading strategy is just one part of the equation.

Because yous still demand a trading routine or you lot won't find trading success. If y'all ask me, this is the hush-hush between winning and losing traders.

You're probably wondering:

"So, how do I develop a trading routine?"

Well, there are 3 parts to information technology…

- Create and update your watch list

- Commit to your schedule (execute and tape)

- Review your results

Let me explain…

1. You create and update your watch list of markets

(This can be done on the weekends when the markets are closed.)

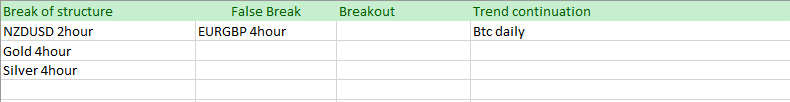

Subsequently you've developed a trading strategy, create a lookout man listing of markets to trade (whether information technology'south Forex, Stocks, Futures, etc.).

Next, scan through your watch listing and identify the markets which offer a potential trading setup (this should exist according to your trading strategy).

You want to "mark" these markets and so you can focus on them in the coming week.

You can do it on excel similar this…

Or if you're using TradingView, y'all can highlight information technology like this…

Next…

2. You commit to your trading schedule

Since you're trading the daily timeframe, then it makes sense to make your trading decision after the close of the daily candle.

This could exist morning, afternoon, or night (depending on where you are) — and then create a schedule where you tin commit to it no matter what.

For instance:

If you're in Asia, then the daily shut would be in the forenoon for you.

And then, every morning time you lot'll cheque the markets from your picket list and meet if at that place's a potential trading setup.

If in that location is, and so you movement onto the side by side step…

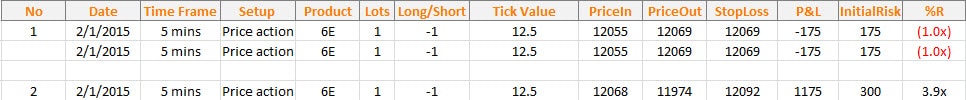

three. You execute and record your trades

Now if there's a valid trading setup, you execute the trade with proper risk management.

So, you'll record the metrics like…

Date – Date you entered your trade

Time Frame – Time frame you entered on

Setup – Trading setup that triggers your entry

Market – Markets y'all're trading

Price in – Toll you entered

Toll out – Price you exited

Stop loss – Price where you lot'll exit when you're wrong

Initial risk in $ – Nominal amount you lot're risking

R multiple – Your P&L on the trade in terms of R. If you made 2 times your take a chance, you fabricated 2R.

An case below:

For the full breakdown, check out this post beneath…

How to be a consistently profitable trader within the next 180 days

4. You review your trades and notice your border

Once y'all've executed 100 trades consistently, you'll know whether your trading strategy has an edge in the markets.

Here's how…

Expectancy = (Winning % * Average win) – (Losing % * Boilerplate loss) – (Commission + Slippage)

If you lot have a positive expectancy, congratulations!

It's likely your trading strategy has an edge in the markets.

But what if it'southward negative?

Then you apply my After technique…

- Identify the patterns that lead to your losses — and avoid trading these setups

- Identify the patterns that lead to your winners — and focus on these setups

- Tweak your trading plan according to your findings

- Execute the next 100 trades with your updated trading plan and tape the trades

- Review your trades

If you do what I only shared, you'll improve your trading results and somewhen, observe your edge in the markets.

Now…

Whether yous're a winning or losing trader, the After technique can be practical to you.

If y'all're a winning trader, then it'll take your trading to the next level.

If you're a losing trader, then you have a method to get yourself into the light-green.

Conclusion

So, here's what you've learned:

- The benefits of trading daily timeframe — y'all're more relaxed, the news doesn't matter, you have freedom, you can grow massive wealth, and you put the odds in your favour

- Trading daily timeframe is not for you if you desire a consistent income or y'all want a career in proprietary trading

- You tin prefer a swing trading or position trading strategy on the daily timeframe

- Your trading routine consists of creating your picket list, committing to your trading schedule, executing your trades, and reviewing your trades

And there you take information technology!

The truth almost trading daily timeframe that nobody tells you.

Now hither's what I'd like to know…

Practise you lot trade on the daily timeframe? Why or why not?

Exit a comment below and share your thoughts with me.

Daily Chart Forex Trading Strategy,

Source: https://www.tradingwithrayner.com/trading-daily-timeframe/

Posted by: weidlersomblifir.blogspot.com

0 Response to "Daily Chart Forex Trading Strategy"

Post a Comment